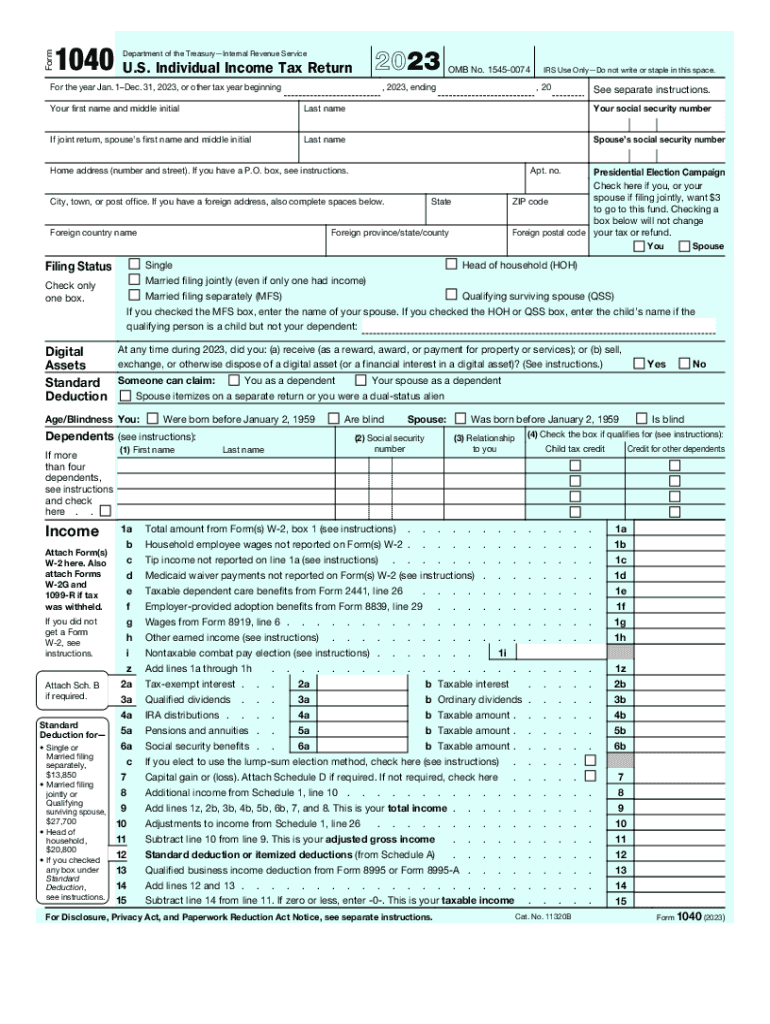

2024 1040 Schedule Builder – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

2024 1040 Schedule Builder

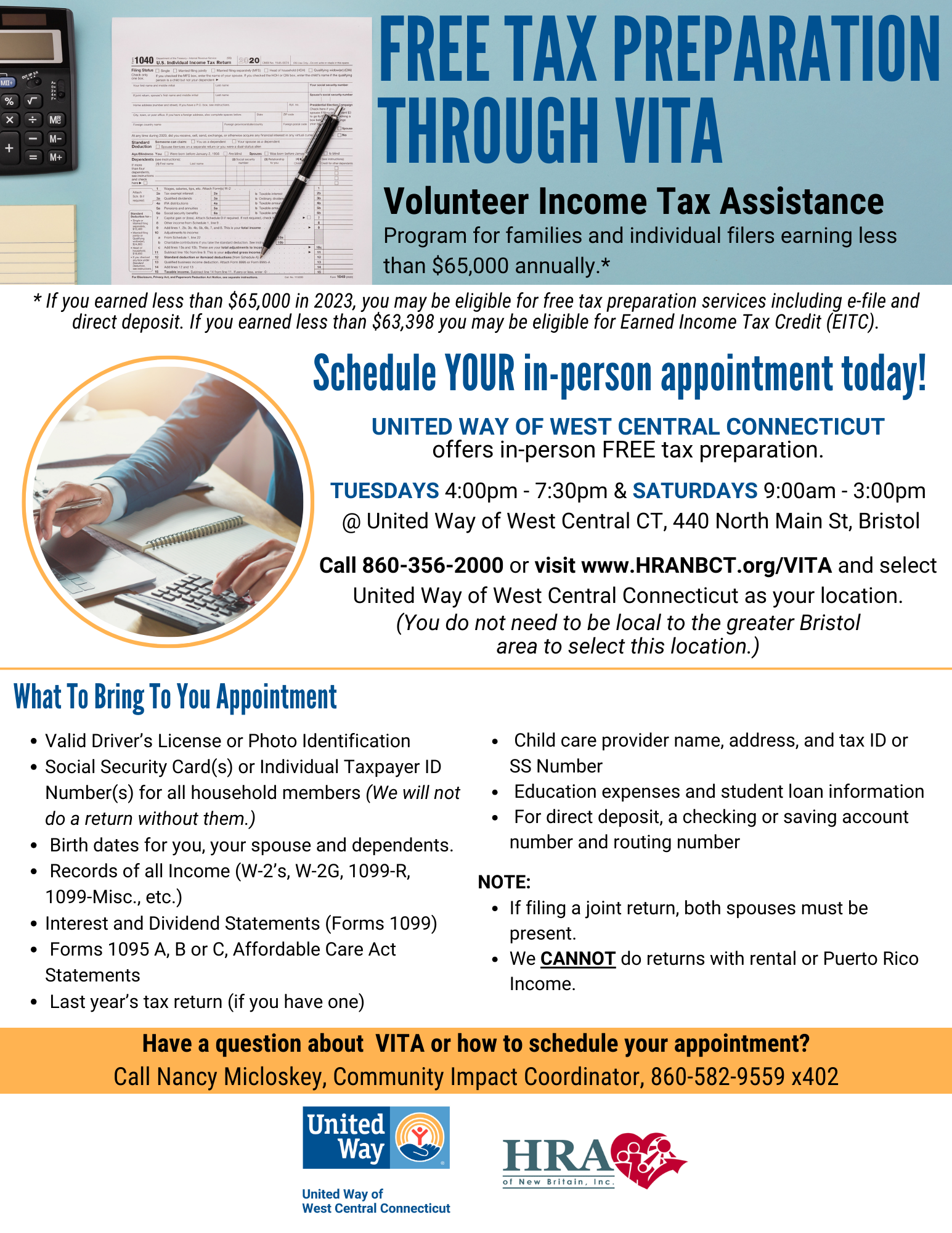

Source : www.uwwestcentralct.orgBasketball training | basketball academy | Atlanta, GA, USA

Source : www.teambobell.comArlin Wallace on LinkedIn: #businesscredit #smallbusinessbigdreams

Source : www.linkedin.comItemized deductions hi res stock photography and images Alamy

Source : www.alamy.com2023 Form IRS 1040 Fill Online, Printable, Fillable, Blank pdfFiller

Source : 1040-form.pdffiller.comUnited Way of Ross County | Chillicothe OH

Source : www.facebook.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgSky Capital Accounting Service Inc. | New York NY

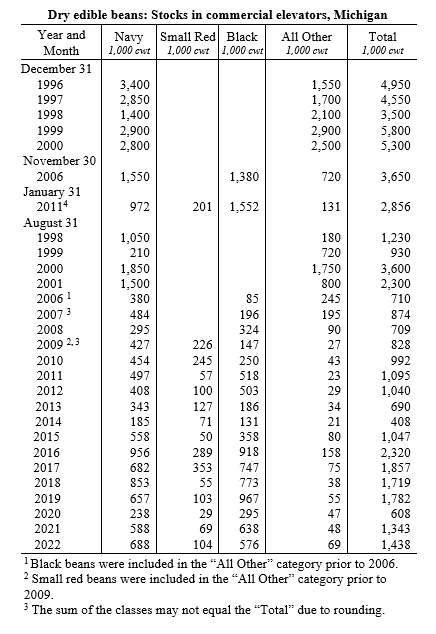

Source : www.facebook.comMDARD MDARD Releases 19th Dry Bean Stocks Report

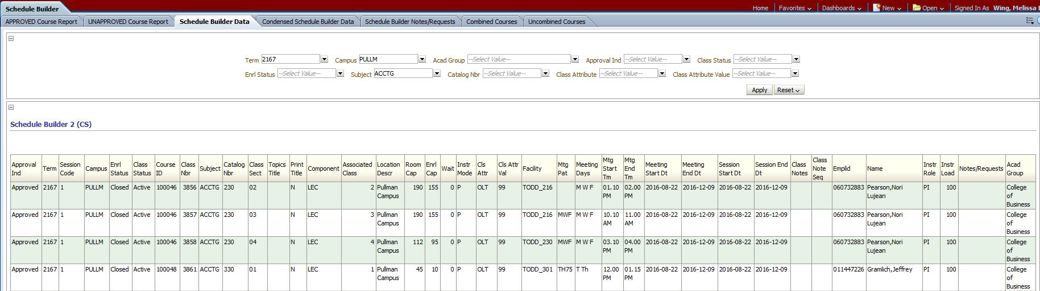

Source : www.michigan.govSchedule Builder Data | Academic Room Scheduling

Source : registrar.schedule.wsu.edu2024 1040 Schedule Builder Free Tax Preparation Service | United Way of West Central Connecticut: You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Complete IRS 1040 Schedule C, “Profit Or Loss From Business.” On the Schedule C, you are required to enter your name, Social Security number, business name (if applicable), business address .

]]>