Unreimbursed Employee Business Expenses 2024 Tax – Weil “The swimming pool one [business] owner was having claiming a deduction that relates to unreimbursed employee expenses. There are also several tax credits you may be able to access. . Question: I am going to have my tax returns prepared for the first time after and the method used for determining the fair market value. · A schedule of any unreimbursed employee business expenses .

Unreimbursed Employee Business Expenses 2024 Tax

Source : www.investopedia.com🚗💨 IRS announces 2024 Standard Mileage Rates! 📈💼 | SIA Group

Source : www.linkedin.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comStandard Business Mileage Rate Going up Slightly in 2024

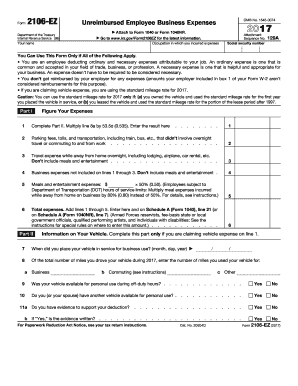

Source : accountants.sva.comIRS 2106 EZ 2017 2024 Fill out Tax Template Online

Source : www.uslegalforms.comExpired Tax Breaks: Deductible Unreimbursed Employee Expenses

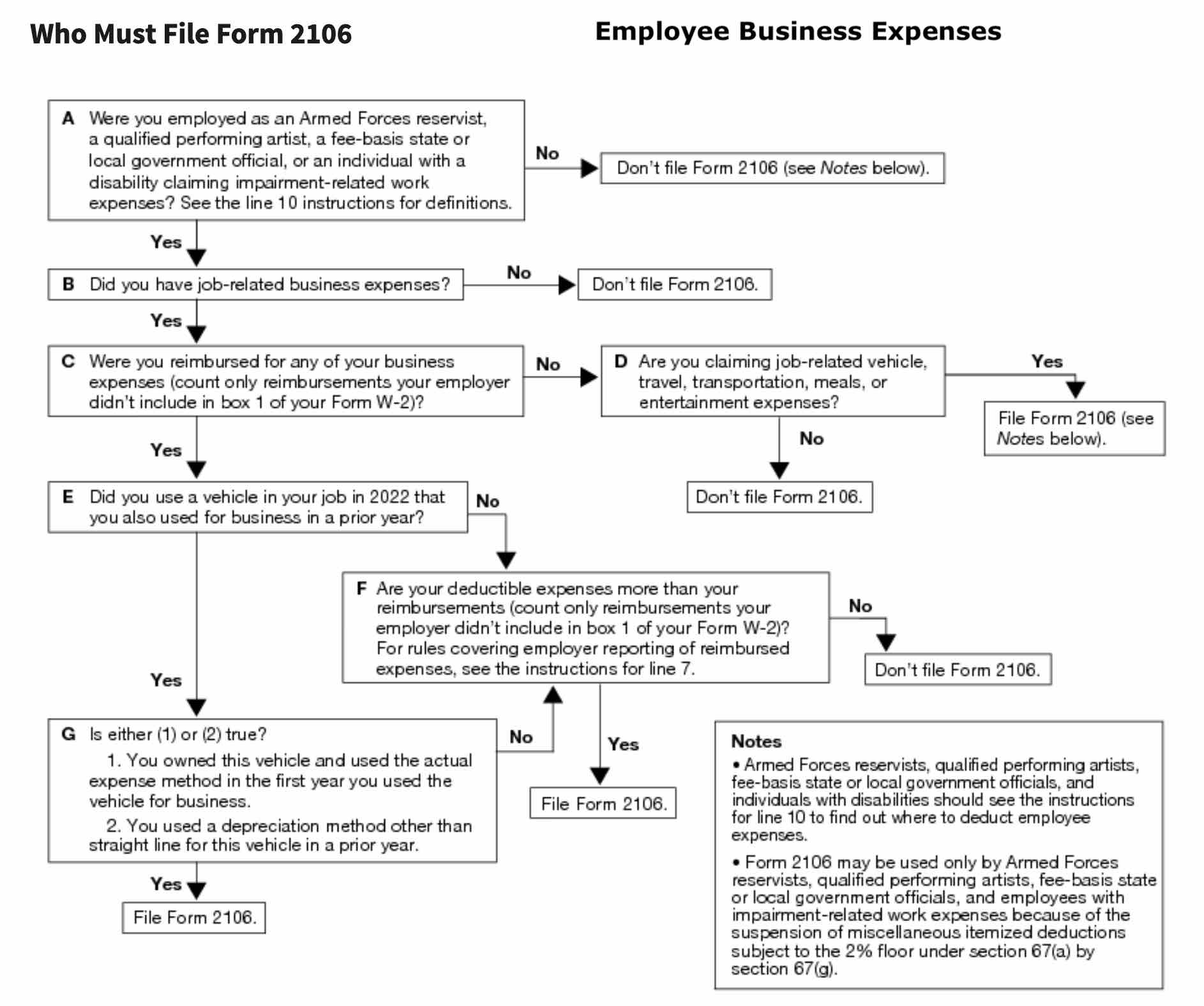

Source : www.efile.comForm 2106: Employee Business Expenses: Definition and Who Can File

Source : www.investopedia.comSIA Group Happy Veterans Day! Today we honor the men and women

Source : m.facebook.comElection 2024 Tax Plans: Details & Analysis | Tax Foundation

Source : taxfoundation.orgDiNatale, CPA+ | Stoneham MA

Source : www.facebook.comUnreimbursed Employee Business Expenses 2024 Tax Form 2106: Employee Business Expenses: Definition and Who Can File: Mule the merrier; cashing out; going for the gold; and other highlights of recent tax cases. Mule the merrier; cashing out; going for the gold; and other highlights of recent tax cases. . Important: Before 2017, traditional employees could claim unreimbursed employee business expenses that exceeded 2% of their adjusted gross income on their tax return, including home office expenses. .

]]>:max_bytes(150000):strip_icc()/Screenshot2024-01-12at4.04.42PM-6ae67168a2a848849de8750450dab1af.png)

:max_bytes(150000):strip_icc()/28374128013_9b6d201c97_k-6dfa7d29e74146d79bf3bf71a3bd544a.jpg)